Open Monday through Friday | 8:00 AM - 6:00 PM | 1-916-549-1189

A trust is a contract or agreement designed to transfer assets to someone else upon the death of the creator of the trust. It is referred to as a “living” trust because you can change it and amend it during your lifetime.

The goal of the Trust is to transfer assets to your beneficiaries without the involvement of the court system (“probate court”). The probate process is public and can be time consuming, expensive, and expose assets to Medi-Cal claims.

There are different positions associated with a Trust

Most trusts are designed to be “revocable” during your lifetime so that you can update them as your circumstances change. Then, when you die the Trust becomes “irrevocable” meaning that the terms of the trust can’t be changed.

| Example of a Single Person with Adult Children | ||

|---|---|---|

|

Parties:

|

Transfer Goals:

|

|

Single Person:

|

Trustor.

The creator of the Trust agreement is called a Trustor:

|

|

Single Person:

|

Trustee. The Trust agreement has a job associated with it called a Trustee who is the manager of the assets in the Trust. The first Trustee is the same person who created the Trust. |

|

Children:

|

Beneficiaries. The children are named as the Beneficiaries who receive the remainder of the assets in the name of the Trust after the death of the parent (trustor). |

|

Trusted Adult:

|

Successor Trustee. In the event person (trustor) dies, then the Trust assets belong to the children (beneficiaries). Usually one of the children is named as the initial successor trustee and the other children are named as alternate successor trustees. |

|

Parties

|

Transfer Goals:

|

|

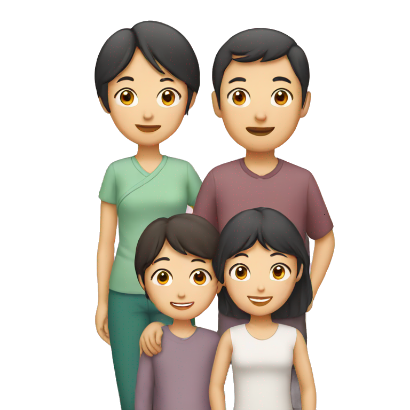

Married Couple:

|

Co-Trustors

The creators of the Trust agreement are called the Trustors:

|

|

Married Couple:

|

Co-Trustees The Trust agreement has a job associated with it called a Trustee who is the manager of the assets in the Trust. The first Trustees are the same parties who created the Trust. |

|

Children | Beneficiaries. The children are named as the Beneficiaries who receive the remainder of the assets in the name of the Trust after the death of the parents (trustors). |

|

Trusted Adult:

|

Successor Trustee. In the event the married couple (trustors) dies, then the Trust assets belong to the children (beneficiaries). Yet, minor children can receive assets. Thus, it is the job of the successor trustee to manage the assets for the children. |

| NOTE: When the children become adults, the husband and wife (trustors) can amend their trust to name them as the successor trustees. | ||

If you are ready to create a living trust, feel free to contact our office today. In office and phone consultations available.

Phone: (916) 549-1189

E-mail: MichaelJohnsonCases@gmail.com

Law Office of Michael Johnson: